Do Index Funds Pay Dividends?

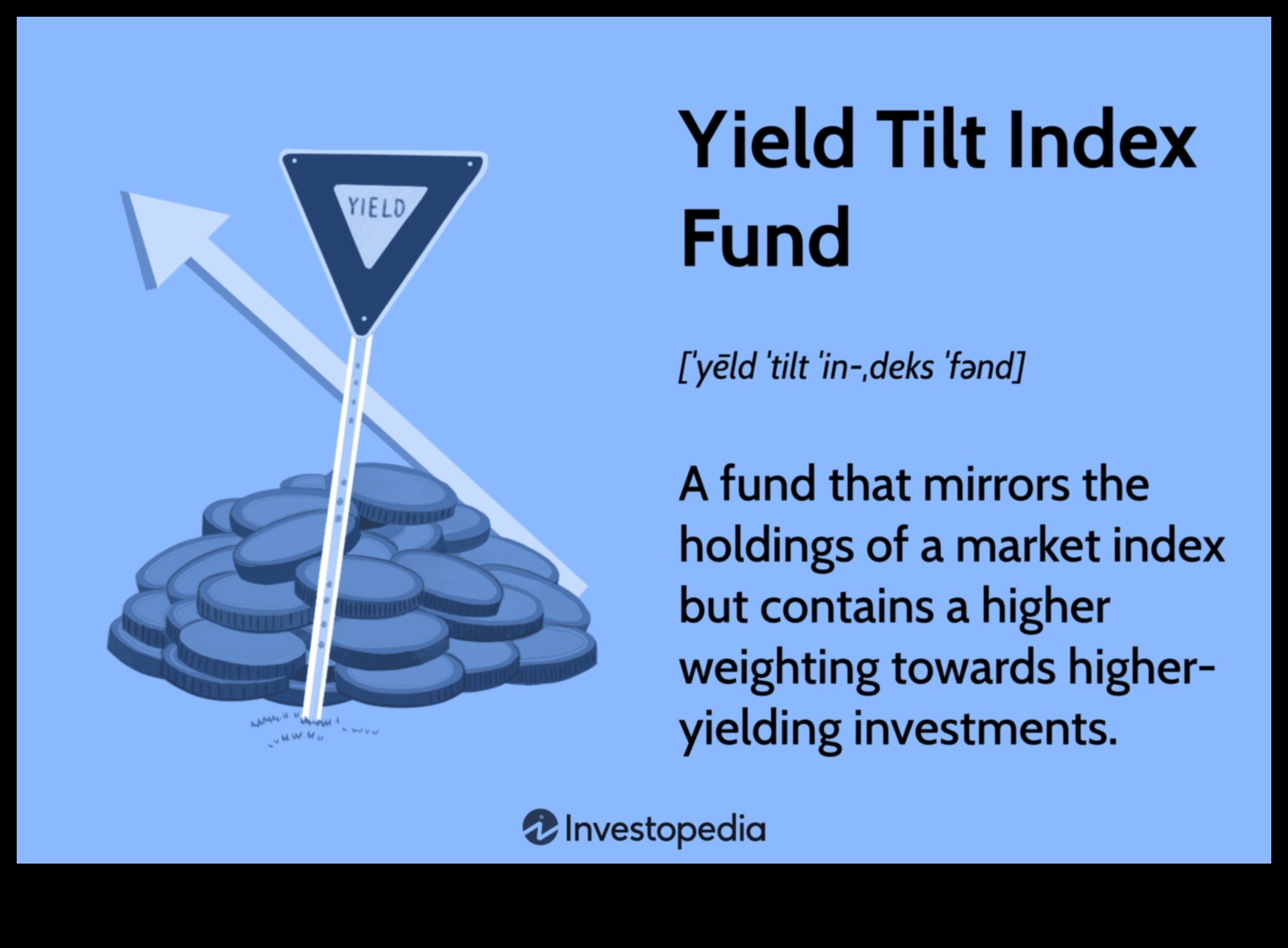

Index funds are a type of mutual fund that tracks the performance of a particular index, such as the S&P 500 or the Dow Jones Industrial Average. Index funds are designed to provide investors with a low-cost way to invest in the stock market, and they typically do not pay dividends.

However, there are some index funds that do pay dividends. These funds are typically called dividend-paying index funds, and they invest in stocks that pay high dividends. Dividend-paying index funds can be a good option for investors who are looking for a source of income from their investments.

In this article, we will discuss the different types of index funds, how they work, and whether or not they pay dividends. We will also provide some tips for investors who are considering investing in dividend-paying index funds.

| Feature | Definition |

|---|---|

| Dividend | A portion of a company’s profits that is paid out to shareholders. |

| Index Fund | A mutual fund or exchange-traded fund (ETF) that tracks a particular market index. |

| Investment | The act of putting money into something in the hope of making a profit. |

| Return | The profit or loss made on an investment over a period of time. |

| Yield | The annual dividend paid out by a stock or fund, expressed as a percentage of its share price. |

II. What is an Index Fund?

An index fund is a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a particular index. This means that the fund’s returns will closely mirror the returns of the index it is tracking.

Index funds are often used by investors who are looking for a low-cost, diversified way to invest. They are also a good option for investors who are new to investing or who do not have a lot of time to manage their investments.

There are many different types of index funds, each tracking a different index. Some of the most popular indexes include the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite.

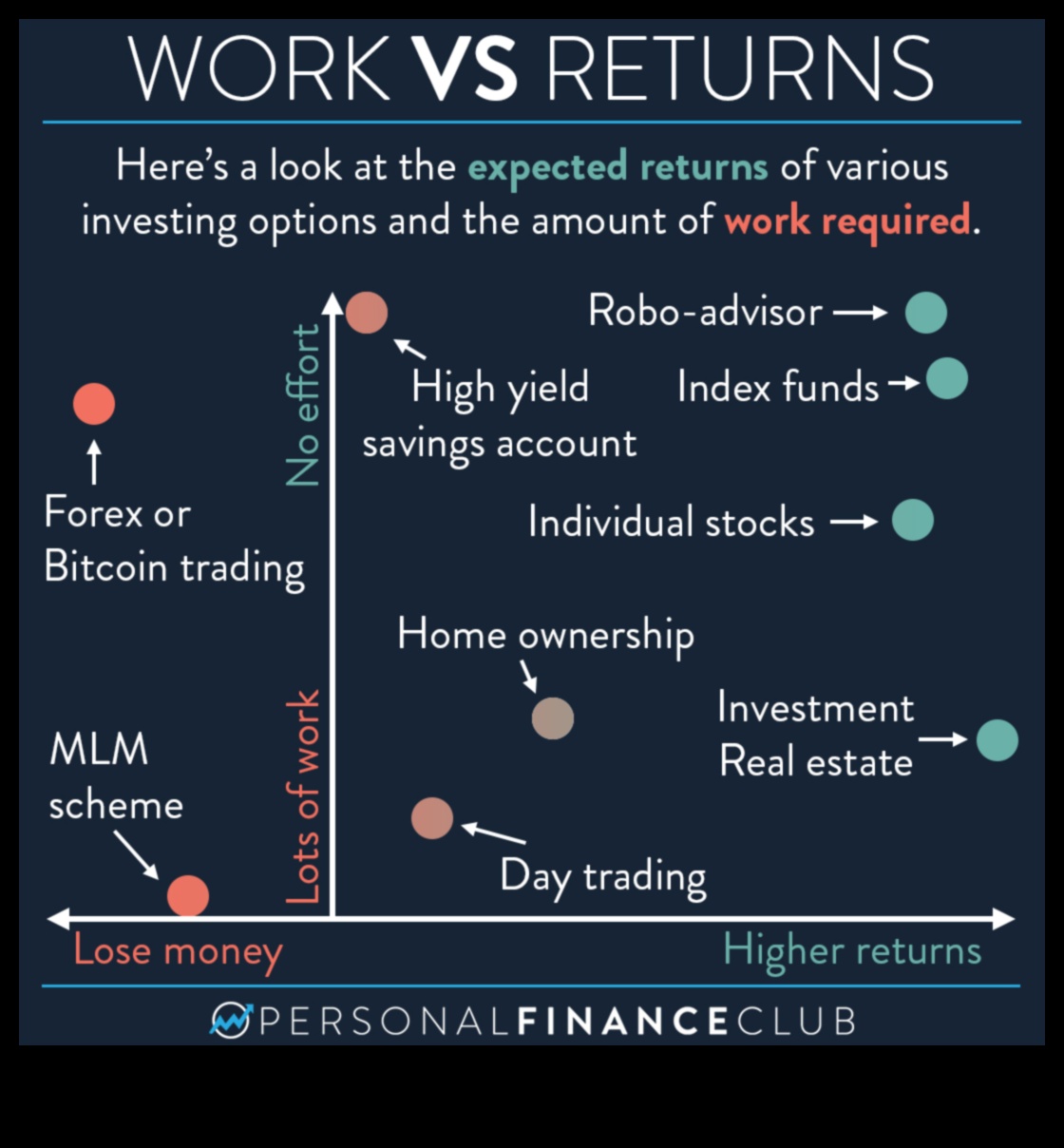

Index funds can be a good investment for a variety of reasons. They are typically low-cost, diversified, and tax-efficient. Additionally, index funds have historically outperformed actively managed funds over the long term.

If you are considering investing in an index fund, it is important to do your research and choose a fund that is appropriate for your goals and risk tolerance.

What is Dividend Yield?

Dividend yield is a financial ratio that measures the amount of a company’s net income that is distributed to shareholders as dividends. It is calculated by dividing the annual dividend per share by the current stock price.

For example, if a company’s stock price is $100 and it pays an annual dividend of $5, its dividend yield would be 5%.

Dividend yield is an important metric for investors to consider when evaluating stocks, as it can provide an indication of the company’s profitability and cash flow. Companies with high dividend yields are often considered to be more stable and reliable investments than those with low dividend yields.

However, it is important to note that dividend yield is not the only factor to consider when evaluating stocks. Other factors such as growth potential, risk, and valuation should also be taken into account.

IV. Why Invest in Index Funds with High Dividend Yields?

There are many reasons why investors may want to consider investing in index funds with high dividend yields. Some of the benefits of investing in these funds include:

- Income: Dividends provide a source of passive income that can help investors supplement their retirement income or other sources of income.

- Growth: Dividend-paying stocks tend to outperform non-dividend-paying stocks over the long term. This is because companies that pay dividends are typically well-established and profitable, and they are more likely to continue to pay dividends in the future.

- Diversification: Index funds with high dividend yields can help to diversify a portfolio and reduce risk. This is because these funds invest in a wide range of stocks from different industries and sectors.

- Tax efficiency: Dividends are taxed at a lower rate than capital gains, which can make them more tax-efficient than other types of investments.

Of course, there are also some risks associated with investing in index funds with high dividend yields. These funds can be more volatile than other types of index funds, and they may not perform as well during periods of economic downturn. Additionally, dividend yields can fluctuate over time, so investors should not rely on dividends as a guaranteed source of income.

Overall, index funds with high dividend yields can be a good investment for investors who are looking for a source of passive income, growth, diversification, and tax efficiency. However, investors should carefully consider the risks associated with these funds before investing.

V. How to Choose the Right Index Fund with High Dividend Yields

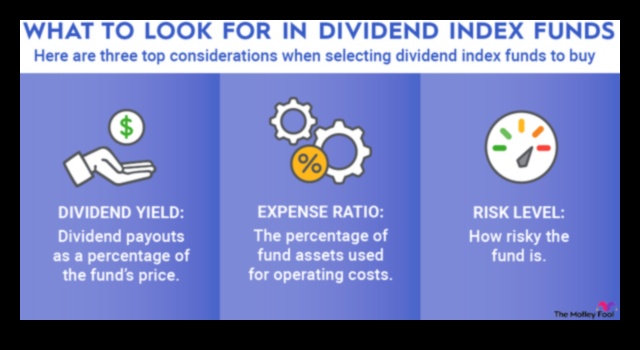

There are a few things to consider when choosing the right index fund with high dividend yields.

- The type of index fund. There are two main types of index funds: passive index funds and active index funds. Passive index funds track a specific index, such as the S&P 500 or the Dow Jones Industrial Average. Active index funds try to outperform the market by actively trading stocks.

- The expense ratio. The expense ratio is the fee that you pay to the fund manager. It is expressed as a percentage of your investment and is deducted from your returns.

- The dividend yield. The dividend yield is the annual dividend divided by the current share price. It is expressed as a percentage.

- The track record. The track record of an index fund is the historical performance of the fund. It can be used to gauge the fund’s risk and potential returns.

Once you have considered these factors, you can start to narrow down your choices. There are a number of resources available to help you choose the right index fund with high dividend yields. You can consult with a financial advisor, read online reviews, or do your own research.

6. Do Index Funds Pay Dividends?

Yes, index funds can pay dividends. However, not all index funds pay dividends, and the amount of dividends paid by an index fund can vary depending on the underlying index.

Index funds that track dividend-paying stocks will typically pay dividends to their shareholders. The amount of dividends paid by an index fund will depend on the dividends paid by the underlying stocks.

Index funds that track non-dividend-paying stocks will not pay dividends to their shareholders.

In general, index funds that track dividend-paying stocks tend to have higher yields than index funds that track non-dividend-paying stocks.

Whether or not an index fund pays dividends is an important factor to consider when choosing an index fund for your investment portfolio. If you are looking for an investment that will generate regular income, then you may want to consider an index fund that pays dividends. However, if you are more concerned with capital appreciation, then you may want to consider an index fund that does not pay dividends.

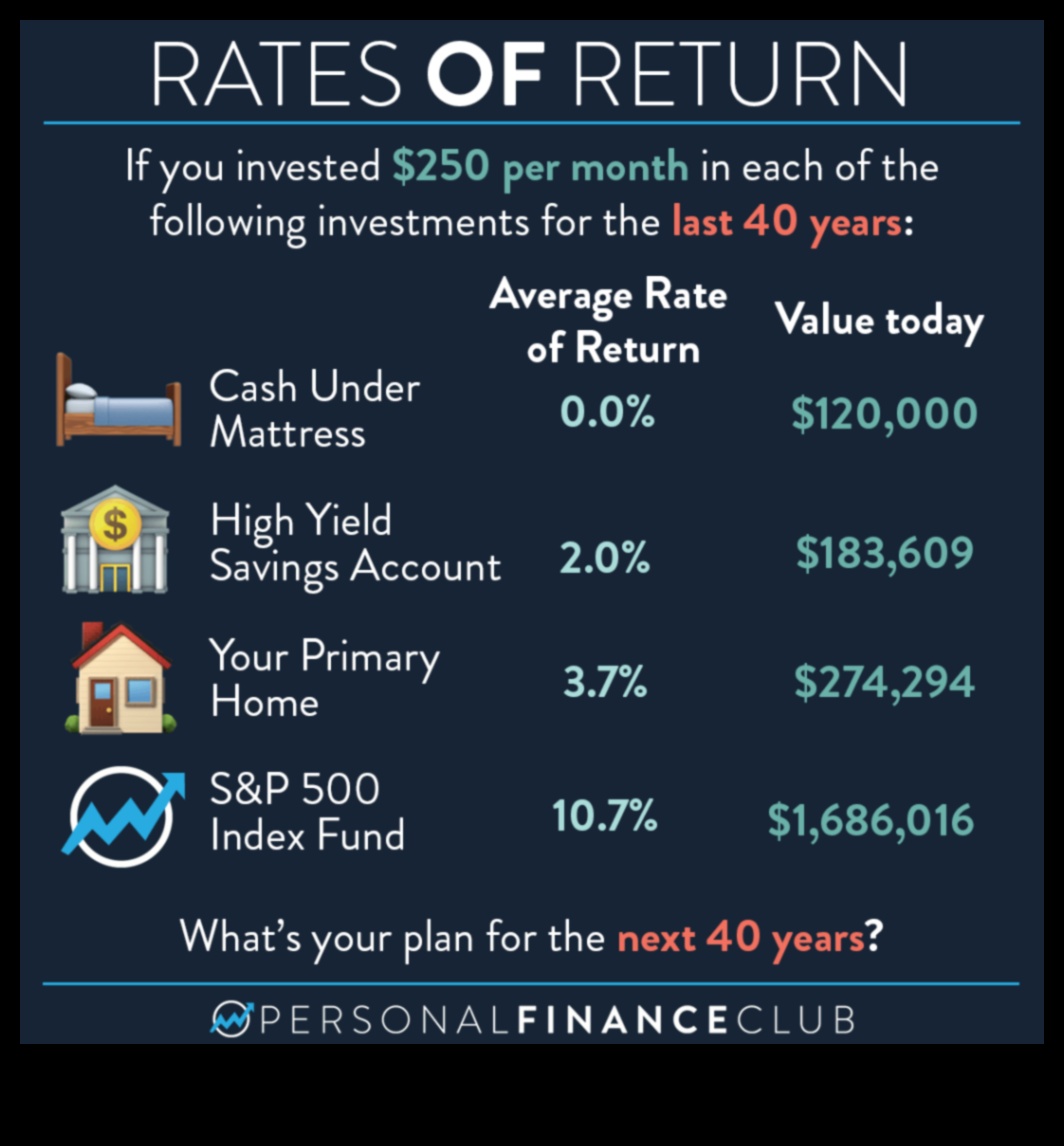

VII. How Much Money Can You Make from Investing in Index Funds with High Dividend Yields?

The amount of money you can make from investing in index funds with high dividend yields depends on a number of factors, including:

- The size of your investment

- The length of time you hold your investment

- The performance of the underlying index

- The dividend yield of the index fund

In general, you can expect to earn a higher return on your investment if you invest for a longer period of time and if the underlying index performs well. However, there is no guarantee that you will make money from investing in index funds with high dividend yields.

The following table provides an example of how much money you could make from investing in an index fund with a high dividend yield. The table assumes that you invest $10,000 in an index fund with a dividend yield of 5% and that you hold your investment for 10 years.

| Year | Dividends Received | Capital Gains | Total Return |

|---|---|---|---|

| 1 | $500 | $0 | $500 |

| 2 | $500 | $0 | $1,000 |

| 3 | $500 | $0 | $1,500 |

| 4 | $500 | $0 | $2,000 |

| 5 | $500 | $0 | $2,500 |

| 6 | $500 | $0 | $3,000 |

| 7 | $500 | $0 | $3,500 |

| 8 | $500 | $0 | $4,000 |

| 9 | $500 | $0 | $4,500 |

| 10 | $500 | $500 | $5,000 |

As you can see, by investing in an index fund with a high dividend yield, you can potentially earn a significant return on your investment over time. However, it is important to remember that there is no guarantee that you will make money from investing in index funds.

If you are considering investing in index funds with high dividend yields, it is important to do your research and understand the risks involved. You should also make sure that you have a long-term investment horizon and that you are comfortable with the volatility of the stock market.

The Pros and Cons of Investing in Index Funds with High Dividend Yields

There are a number of pros and cons to consider when investing in index funds with high dividend yields.

Pros:

- Index funds with high dividend yields can provide a steady stream of income.

- They can be a good way to diversify your portfolio and reduce risk.

- They can be a good way to generate long-term growth.

Cons:

- Index funds with high dividend yields may not be as tax-efficient as other types of investments.

- They may not be as liquid as other types of investments.

- They may not provide as much growth potential as other types of investments.

Ultimately, the decision of whether or not to invest in index funds with high dividend yields depends on your individual financial goals and risk tolerance.

IX. Conclusion

In conclusion, index funds can be a great way to invest for the long term. They offer diversification, low costs, and the potential for high returns. However, it is important to remember that past performance is not indicative of future results. Before investing in any index fund, it is important to do your own research and understand the risks involved.

Here are some additional resources that you may find helpful:

X. FAQ

Q1: What is a dividend?

A dividend is a distribution of earnings paid to shareholders of a company.

Q2: What is an index fund?

An index fund is a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a particular index.

Q3: Why invest in index funds with high dividend yields?

There are a few reasons why you might want to invest in index funds with high dividend yields.

- Dividends can provide a source of passive income.

- Dividend-paying stocks tend to be more stable than non-dividend-paying stocks.

- Dividend-paying stocks can help you to build wealth over time.